If you're planning a trip to Thailand and you're anything like me — always on the hunt for good shopping and better savings — then you’re in for a treat! 😍 As a Malaysian traveler who loves bargain-hunting (especially in places like Bangkok, Chiang Mai, or Phuket), I was super happy to learn that Thailand offers tax refunds for tourists.

Whether you’re stocking up on Thai skincare, fashion, snacks, or even gold jewelry, you can actually claim a portion of the 7% VAT back — and it’s way easier than I expected. 🙌💰

So if you're heading to popular shopping havens like Siam Paragon, MBK Center, or the night markets in Chiang Mai, you’ll want to know how this Thailand VAT refund system works. Trust me — it’s a small effort for some sweet extra cash at the airport! 💼✈️💵

✨ Ready to shop smart in Thailand?

👉 Book your flight to Thailand now on Trip.com

👉 Find hotel deals in Bangkok here

In this post, I’ll break down how Thailand’s tax refund system works, who’s eligible, how much you can get back, and the exact steps I followed to successfully claim my refund. Let’s make sure you don’t leave your money behind in Thailand! 💳✨

🧐 What is a Thailand Tax Refund?

source from https://scandasia.com/

When you shop in Thailand, you pay 7% VAT (Value Added Tax) on most goods. But as a non-Thai tourist, you’re allowed to claim that tax back — either at the airport or via designated refund counters.

It’s like getting a mini cashback just for shopping in Thailand 💵

💰 How Much is VAT in Thailand?

VAT in Thailand is 7%. While that might not sound like a lot, it adds up quickly, especially if you’re shopping for souvenirs, beauty products, or gifts.

🔙 How Much Can I Get Back?

You’ll typically get 4%–6% back, depending on processing fees and refund method. I spent around RM1,500 shopping in Thailand and got back nearly RM90 — which covered my airport meal and coffee! ☕🍱

👤 Am I Eligible for a Tax Refund in Thailand?

Requirement | Details |

|---|---|

Nationality | Non-Thai citizens (Malaysians ✅) |

Minimum Purchase | 2,000 THB per day from a single store |

Refund Processed | At Participating VAT Refund Stores |

Departure | Must leave Thailand within 60 days of purchase via an international airport |

Item Status | Goods must be unused and taken out of Thailand |

🛍️ How Do Tax Refunds Work in Thailand?

It’s quite straightforward! You just need to shop at stores displaying the "VAT Refund for Tourists" sign and follow the process below 👇

You can claim your tax back:

- 💵 At the airport, before your departure

- 🧾 Or via downtown refund counters (for some cases)

💸 Types of Tax Refunds in Thailand

source from https://loyaltylobby.com/

1. In-store Refund Forms

- Buy from VAT Refund Participating Stores

- Spend a minimum of 2,000 THB (about RM260) per day/store

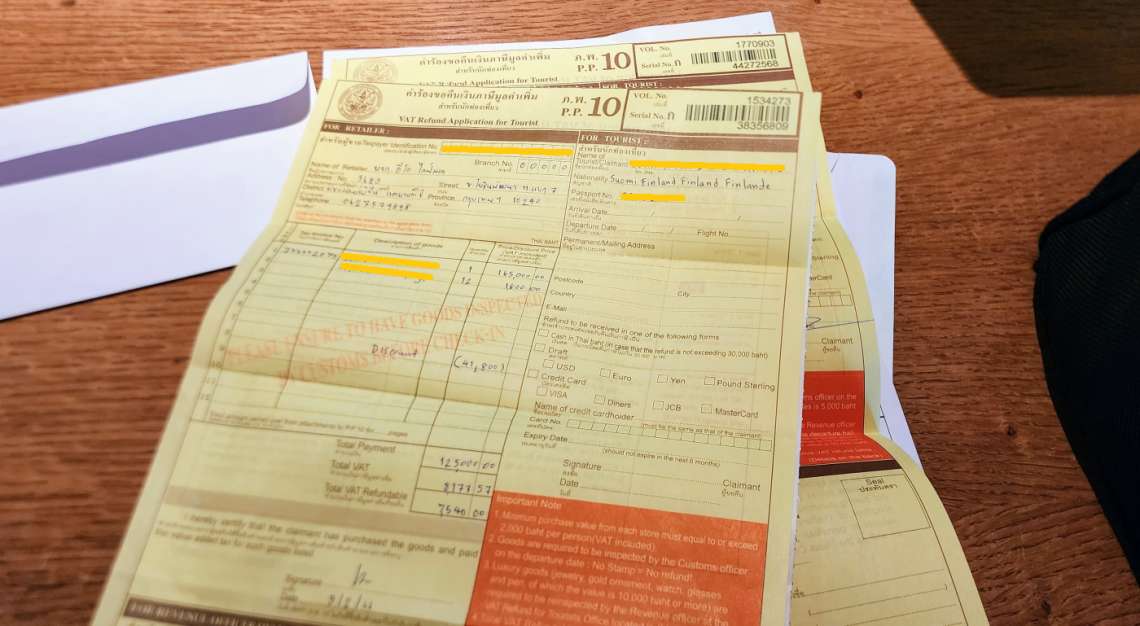

- Ask for the P.P.10 VAT Refund Form when paying

- Bring your passport and keep receipts

2. Airport Refund Process

If you didn’t get an instant refund at the store, here’s how it works at the airport:

Before check-in:

- Go to the VAT Refund Customs Inspection Counter

- Show your unused items, receipts, and P.P.10 forms

- Get them stamped

After immigration:

- Head to the VAT Refund for Tourists Office

- Submit your stamped forms

- Get your refund in cash (THB) or credited to your card

📊 Thailand Tax Refund Summary Table

Requirement | Description |

|---|---|

VAT Rate | 7% |

Refund Amount | ~4%–6% (after fees) |

Minimum Spend | 2,000 THB/day/store |

Refund Limit | No hard limit, but process must follow Customs rules |

Eligible Stores | Stores with “VAT Refund for Tourists” sign |

Refund Method | Cash (THB), Credit Card, Alipay (some locations) |

🚫 Situations Where You Cannot Get a Tax Refund in Thailand

- You are not departing from an international airport (only international flight departures are eligible).

- You leave Thailand more than 60 days after purchase, or do not take the goods out of the country.

- The P.P.10 VAT refund form was not issued on the day of purchase, or contains incorrect information, or you lost the original receipt.

- The goods have been opened, used, or were purchased from stores not participating in the VAT Refund for Tourists program.

Recommended Hotels in Bangkok

🧭 How Do I Get a Tax Refund in Thailand?

✅ Step 1: Shop at VAT Refund Stores

Look out for “VAT Refund for Tourists” signs in malls and stores.

✅ Step 2: Show Your Passport at Checkout

Ask for the P.P.10 form and ensure your passport details are correctly recorded.

✅ Step 3: Keep All Receipts & Items Unused

Don’t remove tags or open the products yet — Customs might inspect them.

✅ Step 4: Get Customs Stamp at the Airport

Arrive 3 hours early at the international airport. Visit the VAT Refund Inspection Desk before check-in.

✅ Step 5: Claim Your Refund After Immigration

Look for the “VAT Refund for Tourists Office”, hand over your documents, and get your money back!

Recommended eSIM Options for Thailand Travel!

1GB 3 Days

- Data1GB Daily

- Validity3 Days

- PriceFrom RM5.93

1GB 5 Days

- Data1GB Daily

- Validity5 Days

- PriceFrom S$3.82

1GB 7 Days

- Data1GB Daily

- Validity7 Days

- PriceFrom RM12.59

5 Days 500MB/Day

- Data500MB Daily

- Validity5 Days

- PriceFrom RM11.36

1 Day 2GB/Day

- Data2GB Daily

- Validity1 Day

- PriceFrom RM4.81

30 Days 1GB/Day

- Data1GB Daily

- Validity30 Days

- PriceFrom RM91.14

💡 Tax Refund Tips in Thailand

📷 Photograph receipts in case of loss

🧳 Don’t check in the items before inspection

⏰ Arrive early — queues at inspection counters can get long

💳 Choose cash if you want instant refund (card refunds take longer)

🛍️ Stick to big malls like CentralWorld, ICONSIAM, Siam Paragon — most are refund-friendly!

💸 Is It Worth Getting a Tax Refund in Thailand?

Yes, definitely! For Malaysians who love shopping and good deals (🙋♀️ that’s me), it’s a no-brainer. Even if it’s just RM50–100 back, that’s enough for a full meal or extra gifts from the airport duty-free.

So if you’re spending in Thailand, make sure you don’t leave your money behind — claim your refund and treat yourself before boarding! 🛫🎁🍹

🧳 Final Thoughts on Tax Refund in Thailand

After experiencing it myself, I can say without a doubt — claiming a tax refund in Thailand is absolutely worth it! 🙌 Whether you’re splurging at Siam Paragon, bargain-hunting at Chatuchak, or picking up a few last-minute souvenirs at the airport, getting back a portion of your spending is like a sweet bonus at the end of your trip.

As a Malaysian traveler who loves a good deal (who doesn't? 😄), I found Thailand’s VAT refund system easy, convenient, and very rewarding. The little effort it takes to keep receipts and visit the refund counter really pays off — especially when that refund covers your airport meal, coffee, or even a small gift for someone back home. 🎁☕✈️

So next time you’re heading to Thailand, remember: shop smart, keep your receipts, and claim your VAT refund before you fly home. It’s your money — don’t leave it behind!

👉 Book your flight to Thailand now on Trip.com

👉 Find hotel deals near Siam, Phuket, or Chiang Mai here

👉 Pre-order a Thailand eSIM to stay connected on the go

Happy shopping, happy savings — and don’t forget that refund! 🛍️💳💼

Frequently Asked Questions

❓1. What is a VAT refund in Thailand?

Thailand charges a 7% Value Added Tax (VAT) on most goods. But as a non-Thai tourist, you can get a portion of that VAT refunded when you shop at participating stores and take the goods out of the country. It’s like getting cashback just for spending! 💸❓2. Am I eligible for a tax refund in Thailand?

Yes, if you: ✅ Are not a Thai citizen ✅ Spend at least 2,000 THB (approx. RM260) at a participating store in one day ✅ Are departing Thailand via an international airport ✅ Leave within 60 days of purchase ✅ Take the goods out of Thailand, unused and in your carry-on❓3. What is the minimum purchase amount to get a tax refund?

You must spend a minimum of 2,000 THB in a single day at one participating store to qualify. Some stores may also have a combined minimum to process the P.P.10 tax refund form.❓4. How much VAT will I get back?

Thailand’s VAT is 7%, but after fees, you’ll usually get back around 4%–6% of your purchase amount. Refunds can be given in cash, to your credit card, or sometimes through e-wallets like Alipay or WeChat Pay.❓5. What is the P.P.10 form?

The P.P.10 form is the official VAT refund application form issued by stores in Thailand. You must get this on the day of purchase. Without it, you can't claim your refund.❓6. Where do I claim my VAT refund?

You’ll claim your refund at the airport when leaving Thailand. Here's how: Before check-in: Visit the VAT Refund Inspection Counter with your goods, receipts, and P.P.10 form to get approval. After immigration: Go to the VAT Refund for Tourists Office to submit your documents and receive your refund.❓7. Can I get a refund if I already used the product?

No. The items must be unused, unopened, and carried with you (especially electronics and high-value items). Customs officers may ask to inspect them.❓8. What types of goods are eligible?

Most consumer goods are eligible, such as: 🧴 Skincare and cosmetics 👜 Fashion and accessories 🎧 Electronics 🧣 Silk products and souvenirs 🚫 Services (like hotels or massage), food, or anything consumed in Thailand are not eligible for VAT refunds.❓9. Can I shop online or get a refund at non-participating stores?

No. Only purchases made in-store at shops displaying the “VAT Refund for Tourists” sign are eligible. Online purchases or items from local markets without proper receipts won't qualify.❓10. What if I forget to get my receipt stamped at the airport?

Unfortunately, no customs stamp = no refund. The stamp proves you’re taking the goods out of Thailand. Always arrive early (at least 3 hours before your flight) to avoid missing this step.❓11. Is there a maximum refund amount?

There’s no strict limit, but: If your refund is under 30,000 THB, you can get cash or e-wallet refund. If it's over 30,000 THB, refunds are given only via credit card or bank cheque, and a postage fee may apply.

NO.1

NO.1